Direct Depositing Your Tax Refund to Bluebird Is Quick and Easy

Your Guide to Help with Tax Season

Before You File

Deposit funds into your Bluebird Account whether you file directly with the IRS or work with a tax professional.

for more information on filing your taxes

When You File

Ensure your refund is added to your Bluebird Account with the guidelines below.

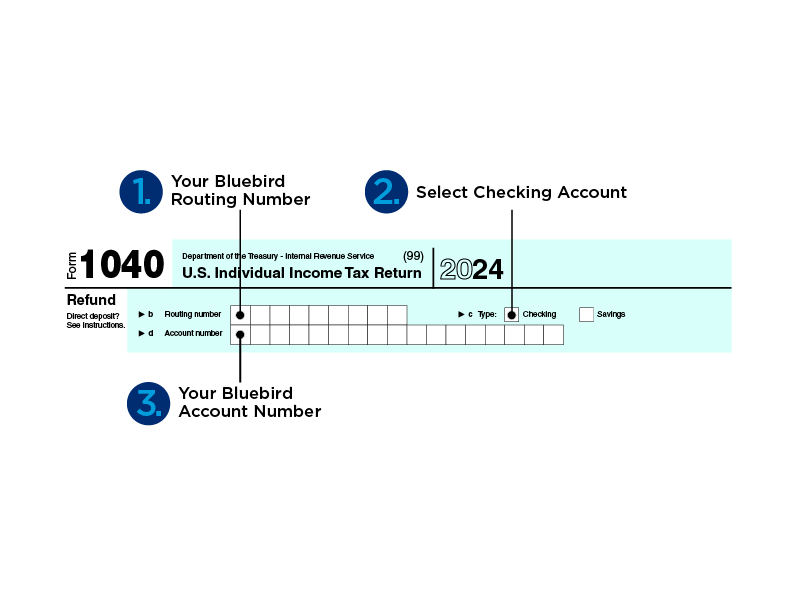

How to fill out your tax form for Direct Deposit:

1. Log in to your Account.

2. Get your Bluebird Account and Routing numbers.

3. Enter your Account and Routing numbers in the "Refund" section of your tax return and select "Checking" as the type of account.

Important Reminders

After You File

Let Bluebird's features and benefits help you get more out of your tax refund

Shop

Pay Bills

Security

Cash Access

Direct Deposit

Staying Informed About Your Tax Refund Status

You can check your refund status anytime by using:

- IRS tool

-

- or by calling the IRS at 800-829-1954

Only the IRS will have the updated information on the status of your tax refund. Bluebird will notify you once your refund has been received and is ready for you to access. Then you can use your refund.

Frequently Asked Questions

Can I have my federal tax refund added to my Bluebird® Bank Account?

Yes! With Direct Deposit, get access to your federal tax refund up to 6 days faster than a standard electronic deposit from the IRS.1 Your tax refund will be added to your account as soon as your return is processed and completed by the IRS. To check the status of your refund, please visit the IRS Where’s My Refund tool, IRS2Go App, or by calling the IRS at 800-829-1954.

If your state allows, you can Direct Deposit your state tax refund to your Bluebird account. Please consult your state for instructions.

What should I do before filing my taxes?

- Make sure you have registered for a Bluebird account. If you do not have an account, click here to see how to get a Bluebird account.

- Verify your email address that you used to register.

- If you purchased a Bluebird® American Express® Reloadable Prepaid Card at a store, you must complete online registration, verify your email and activate your personalized Bluebird card that you received in the mail.

- Locate your Bluebird Account and Routing numbers, which you’ll need when you file. You can find them by logging in to your account.

Can I get my tax refund added to my account if I am filing jointly?

Yes. However, in order to avoid a delay in receiving your funds, the primary name on the account must match the name and social security number that we have on file. If you are listed as the primary name on the account, you cannot be listed as "spouse" on your tax return. If this is not filled out correctly, your refund could be rejected, resulting in a potential delay in receiving your funds from the IRS.

How do I check the status of my refund?

You can check that status of your refund on the IRS Where’s My Refund? tool, the IRS2Go App, or by calling the IRS at 800-829-1954. The IRS information is updated every 24 hours. Bluebird Customer Service does not have information on the status of your refund until it has posted to your account. According to the IRS, most refunds are issued in less than 21 calendar days. It will take 24-48 hours for your funds to be available on Bluebird after your refund has been released by the IRS. You will receive an email from Bluebird once the refund has posted to your account.

Can I have my federal tax refund added to my Bluebird® American Express® Prepaid Debit Account?

Yes! With Direct Deposit, get access to your federal tax refund up to 5 days faster5 than a standard electronic deposit from the IRS.1 Your tax refund will be added to your account as soon as your return is processed and completed by the IRS. To check the status of your refund, please visit the IRS Where’s My Refund tool, IRS2Go App, or by calling the IRS at 800-829-1954.

If your state allows, you can Direct Deposit your state tax refund to your Bluebird account. Please consult your state for instructions.

How do I fill out my tax forms to have my refund added to my Bluebird account?

Follow the steps below to successfully add your tax refund to your Bluebird account:

- Ensure that the primary name and Social Security Number on your tax return matches the name on your Bluebird account exactly.

- In the Refund section of the tax return:

- Fill in your Bluebird Routing number

- Fill in your Bluebird Account number

- Select "Checking" as the type of account

How many refunds can I receive on my account?

There is a limit of two tax refunds per calendar year per account. You could receive both a federal and state refund on your account for a total of two refunds.

Can I receive tax refunds for other people on my account?

No. In accordance with IRS guidelines, you cannot Direct Deposit someone else's refund to your account. In this case, the deposit of the tax refund will be rejected.

If you have a Subaccount that is used by another person, you cannot receive a tax refund for that person on your Bluebird account.

Where can I go for additional information about filing my taxes?

Please consult the for any other inquires specific to your tax refund.